Online Scams Targeting Seniors

Fraud and online scams is the number one crime committed against seniors in Canada.

Some of the more common senior scams involve telemarketing, internet scams, investment schemes and unsecured reverse mortgages. According to the Federal Bureau of Investigation, seniors in the U.S. lost $1.8 BILLION to online fraud in 2020.

Online scams are on the rise, as more seniors gain access to technology and are learning how to navigate the digital world. But seniors also need to be made aware of the dangers that can lurk within their screens.

These are the top 2 online scams that are being perpetuated against seniors right now:

Internet Fraud

Seniors new to technology easily fall prey to these kinds of online scams. Emails and links that cause computer viruses that open information on their computer to scammers. Internet fraud can include emails asking for financial help, or there’s a problem with your bank account or tax refund. This will usually result in a phone call, and the voice on the other end can be aggressive and can try to intimidate the senior calling. Not only resulting in the loss of thousands in funds, but in dignity as well.

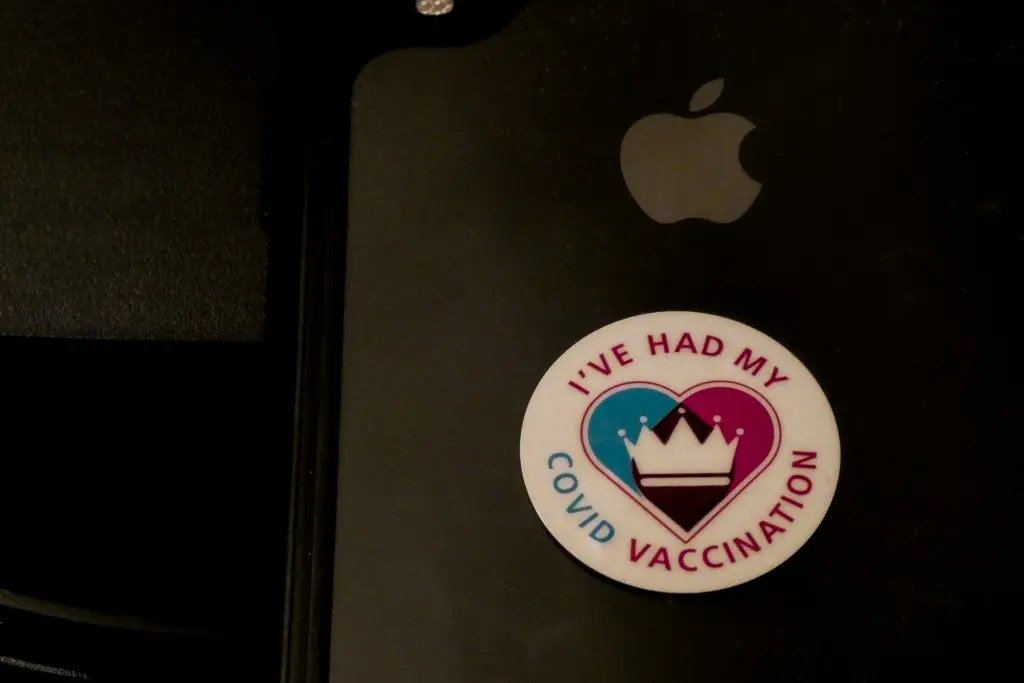

COVID-19 Vaccination Card scam

This is a VERY new online scam against seniors that fraudsters jumped on. Not specifically targeted to seniors only, but anyone who posts selfies on social media after they receive their shot. As with any personal information, do NOT provide scammers with your full name, date of birth, and any information about where, when you get your vaccination. This is all they need to break into bank accounts and start applying for credit cards in your name. Identity theft! Best way to avoid this scam is to not post at all, or just notify your friends and family with a generic image.

These are the ways that we can protect our seniors from online scams.

- Importantly, have a conversation with your senior loved ones, and let them know that this kind of thing actually happens to seniors – make them aware of their risk

- Seniors need to stay connected with friends and family, and involved with community activities where they can, and this can, indeed, reduce isolation

- Teach them to recognize odd email requests and strange links and to NOT open them, and also that banks never ask customers to click on links to verify information

- They need to learn to refuse to speak with anyone who calls or comes to the door asking for donations or selling things. Furthermore, help seniors realize the POWER of the HANG UP. Hang up the phone!

- Make them understand to NEVER give credit card, banking, or personal information over the phone

Check out these resources for information on online scams and ways that seniors can protect themselves and their hard earned retirement funds.

https://www.rcmp-grc.gc.ca/en/seniors-guidebook-safety-and-security

https://www.antifraudcentre-centreantifraude.ca/index-eng.htm